Introduction to REIT Investing

Investing in real estate can be a lucrative venture, but it often requires a significant amount of capital and expertise. However, with the advent of Real Estate Investment Trusts (REITs), individuals can now tap into the real estate market without directly managing properties. REITs have become a popular investment vehicle, offering a unique combination of benefits that can enhance any investment portfolio. In this article, we will delve into the advantages of REIT investing, exploring how it can provide diversification, income generation, and liquidity, among other benefits.

What are REITs?

Definition and History

REITs are companies that own or finance real estate properties and provide a way for individuals to invest in real estate without directly managing properties. The concept of REITs was first introduced in the United States in 1960, with the aim of making real estate investing more accessible to the general public. Since then, REITs have become a global phenomenon, with many countries adopting similar structures to facilitate real estate investment.

How REITs Work

REITs work by allowing individuals to buy shares in a company that owns or finances real estate properties. These properties can range from office buildings and apartments to shopping centers and hotels. REITs generate income through rental payments or interest from loans and distribute a significant portion of this income to shareholders in the form of dividends. This unique structure allows REITs to provide a steady stream of income while also offering the potential for long-term capital appreciation.

Benefits of Investing in REITs

Diversification

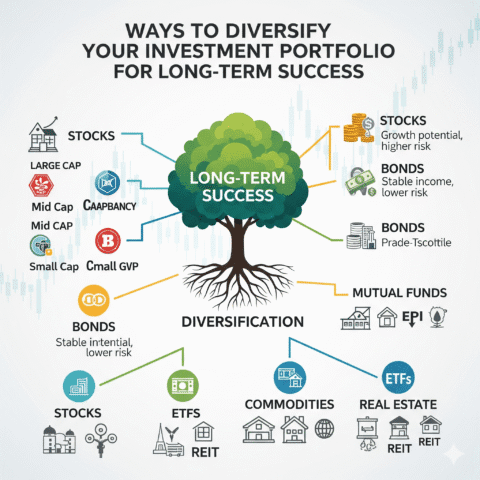

One of the primary benefits of investing in REITs is diversification. Real estate investing often follows different market trends compared to stocks and bonds, making REITs an excellent addition to a diversified investment portfolio. By investing in REITs, individuals can reduce their reliance on any one particular asset class, potentially lowering their overall investment risk.

-

- Reduced Risk: Diversification through REITs can help spread risk across different asset classes.

-

- Increased Potential Returns: A diversified portfolio that includes REITs may offer higher potential returns over the long term.

Income Generation

REITs are known for their ability to generate consistent income through dividend payments. This makes them an attractive option for investors seeking regular income, such as retirees or those looking to supplement their current income.

-

- Steady Income Stream: REITs are required to distribute a significant portion of their income to shareholders, providing a steady income stream.

-

- Potential for Income Growth: As property values and rental rates increase, so too can the dividend payments from REITs.

Liquidity

Unlike direct real estate investment, REITs offer liquidity to investors. Shares in REITs are traded on major stock exchanges, allowing investors to easily buy and sell their shares as needed.

-

- Easy to Buy and Sell: REIT shares are listed on stock exchanges, making it simple for investors to enter or exit the market.

-

- No Lock-in Periods: Investors can sell their REIT shares at any time, providing flexibility in their investment strategy.

Professional Management

REITs are managed by professionals with extensive experience in real estate investment and management. This expertise ensures that properties are well-maintained and managed to maximize returns.

-

- Expert Knowledge: Professional managers have the knowledge and skills to optimize property values and income.

-

- Reduced Management Burden: Investors do not need to be involved in the day-to-day management of properties, freeing up time for other pursuits.

Transparency and Regulation

REITs are subject to strict regulatory requirements and must disclose their financial information regularly. This transparency provides investors with a clear understanding of the REIT’s performance and financial health.

-

- Regular Financial Reporting: REITs must issue regular financial reports, ensuring transparency and accountability.

-

- Strict Regulatory Environment: Regulatory oversight helps protect investor interests and maintain market integrity.

Access to Large-Scale Investments

Through REITs, individuals can invest in large-scale real estate projects that would otherwise be out of reach. This includes investments in commercial properties, such as office buildings and shopping malls, which can provide significant rental income.

-

- Investment in Large-Scale Projects: REITs allow individuals to participate in large real estate investments.

-

- Diversified Property Portfolio: Investors can gain exposure to a diversified portfolio of properties through a single REIT investment.

Tax Efficiency

REITs can offer tax benefits to investors. The income distributed by REITs is typically considered ordinary income, but the tax efficiency can vary depending on the jurisdiction and the specific structure of the REIT.

-

- Tax Benefits: Depending on the tax laws in your jurisdiction, investments in REITs may offer certain tax advantages.

-

- Consult a Tax Professional: It’s essential to consult with a tax professional to understand the specific tax implications of REIT investments in your situation.

Potential for Long-Term Growth

In addition to generating income, REITs also offer the potential for long-term capital appreciation. As property values increase over time, the value of the REIT shares can also increase, providing investors with a potential long-term growth opportunity.

-

- Capital Appreciation: The value of REIT shares can increase over time, reflecting growth in property values.

-

- Long-Term Investment Strategy: REITs can be a valuable component of a long-term investment strategy, offering both income and growth potential.

Inflation Protection

Real estate values and rental income tend to increase with inflation, making REITs a potentially effective hedge against inflation. As inflation rises, the value of the properties owned by the REIT and the rental income they generate can also increase, helping to protect the purchasing power of the investment.

-

- Inflation Hedge: REITs can provide a degree of protection against inflation, as property values and rental income tend to increase with inflation.

-

- Preservation of Purchasing Power: By investing in REITs, individuals can help protect their investment’s purchasing power over time.

Access to Global Real Estate Markets

Through REITs, investors can gain access to global real estate markets, allowing for diversification across different geographic regions. This can provide exposure to emerging markets and sectors with high growth potential.

-

- Global Diversification: REITs offer the opportunity to invest in real estate markets worldwide.

-

- Emerging Markets and Sectors: Investors can access emerging real estate markets and sectors through global REITs.

Frequently Asked Questions About REITs

What is the Minimum Investment Required for REITs?

The minimum investment required for REITs can vary widely, from a few thousand dollars to much larger sums, depending on the specific REIT and the investment platform used.

How Do I Invest in REITs?

Investing in REITs can be done through various channels, including buying shares directly on the stock exchange, investing through a real estate mutual fund, or using a real estate investment platform.

Are REITs Suitable for All Investors?

REITs can be suitable for a wide range of investors, from beginners to experienced investors, depending on their investment goals and risk tolerance. However, it’s essential for investors to understand the potential risks and benefits associated with REIT investments.

Pro Tips and Best Practices for REIT Investing

Start with a Diversified Portfolio

Beginning with a diversified portfolio that includes a mix of different asset classes can help reduce risk and increase potential returns.

Conduct Thorough Research

It’s crucial to conduct thorough research on any REIT before investing, looking into its financial health, management team, and investment strategy.

Set Clear Investment Goals

Setting clear investment goals, whether it’s for income generation, long-term growth, or a combination of both, can help guide your REIT investment strategy.

Regularly Review Your Portfolio

Regularly reviewing your investment portfolio can help ensure that it remains aligned with your investment goals and risk tolerance.

Conclusion

Investing in REITs can offer a unique combination of benefits, including diversification, income generation, liquidity, and potential for long-term growth. Whether you’re a seasoned investor or just starting out, REITs can be a valuable addition to your investment portfolio. By understanding the advantages and risks associated with REIT investments and following best practices for investing, you can make informed decisions that align with your financial goals. As with any investment, it’s essential to conduct thorough research, set clear investment goals, and regularly review your portfolio to ensure it remains on track.

Consider adding REITs to your investment strategy today and explore how they can help you achieve your financial objectives.