Investing in the stock market or other assets can seem like a daunting task, especially for those with limited capital. However, with the rise of micro-investing apps and other low-cost investment options, it’s now possible to start investing with as little as $100. In this article, we’ll explore 10 ways to start investing with just $100, making it accessible to anyone looking to grow their wealth.

Introduction to Micro-Investing

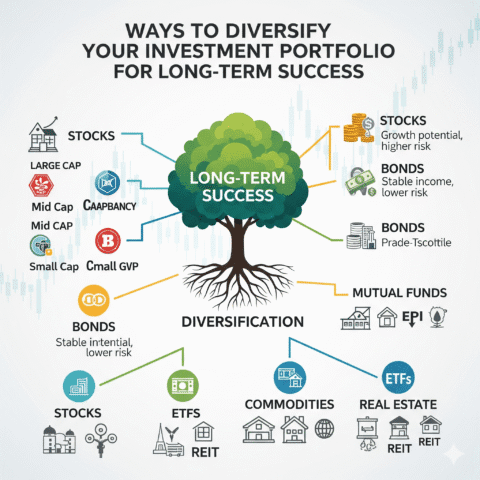

Micro-investing refers to the practice of investing small amounts of money into various assets, such as stocks, bonds, or ETFs. This approach is ideal for beginners or those with limited capital, as it allows them to diversify their portfolio and minimize risk. With micro-investing apps, users can invest as little as $1 into a variety of assets, making it an attractive option for those looking to start small.

Benefits of Micro-Investing

The benefits of micro-investing are numerous. For one, it allows users to invest small amounts of money, making it accessible to anyone. Additionally, micro-investing apps often have low or no fees, making it a cost-effective way to invest. Moreover, micro-investing enables users to diversify their portfolio, reducing risk and increasing potential returns.

1. Micro-Investing Apps

Micro-investing apps, such as Acorns or Robinhood, allow users to invest small amounts of money into a variety of assets. These apps often have low or no fees, making it an attractive option for those looking to start small. For instance, Acorns enables users to invest as little as $1 into a portfolio of ETFs, while Robinhood offers commission-free trades.

- Examples of micro-investing apps:

-

- Acorns

-

- Robinhood

-

- Stash

- Benefits of micro-investing apps:

-

- Low or no fees

-

- Accessibility

-

- Diversification

2. Index Funds

Index funds are a type of investment that tracks a specific market index, such as the S&P 500. They offer broad diversification and can be a low-cost way to invest in the stock market. With index funds, users can invest as little as $100, making it an attractive option for beginners. For example, Vanguard’s S&P 500 Index Fund has a minimum investment requirement of just $100.

- Examples of index funds:

-

- Vanguard’s S&P 500 Index Fund

-

- Fidelity’s 500 Index Fund

- Benefits of index funds:

-

- Broad diversification

-

- Low costs

-

- Simplicity

3. ETFs

Exchange-traded funds (ETFs) are similar to index funds but trade on an exchange like stocks. They offer flexibility and can be traded throughout the day. With ETFs, users can invest as little as $100, making it an attractive option for those looking to start small. For instance, the SPDR S&P 500 ETF Trust has a minimum investment requirement of just $100.

- Examples of ETFs:

-

- SPDR S&P 500 ETF Trust

-

- iShares Core S&P Total U.S. Stock Market ETF

- Benefits of ETFs:

-

- Flexibility

-

- Trading flexibility

-

- Diversification

4. Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to manage a user’s portfolio. They often have low fees and can be a good option for those who are new to investing. With robo-advisors, users can invest as little as $100, making it an attractive option for beginners. For example, Betterment’s minimum investment requirement is just $100.

- Examples of robo-advisors:

-

- Betterment

-

- Wealthfront

- Benefits of robo-advisors:

-

- Low fees

-

- Automation

-

- Diversification

5. Peer-to-Peer Lending

Peer-to-peer lending platforms, such as Lending Club or Prosper, allow users to lend money to individuals or small businesses. This type of investment offers a fixed return and can be a good option for those looking for a low-risk investment. With peer-to-peer lending, users can invest as little as $100, making it an attractive option for those looking to start small.

- Examples of peer-to-peer lending platforms:

-

- Lending Club

-

- Prosper

- Benefits of peer-to-peer lending:

-

- Fixed returns

-

- Low risk

-

- Accessibility

6. Real Estate Crowdfunding

Real estate crowdfunding platforms, such as Fundrise or Rich Uncles, allow users to invest in real estate development projects or existing properties. This type of investment offers a potential for long-term growth and can be a good option for those looking for a diversified portfolio. With real estate crowdfunding, users can invest as little as $100, making it an attractive option for those looking to start small.

- Examples of real estate crowdfunding platforms:

-

- Fundrise

-

- Rich Uncles

- Benefits of real estate crowdfunding:

-

- Potential for long-term growth

-

- Diversification

-

- Accessibility

7. Certificates of Deposit (CDs)

Certificates of deposit (CDs) are time deposits offered by banks with a fixed interest rate and maturity date. They offer a low-risk investment option and can be a good choice for those looking for a fixed return. With CDs, users can invest as little as $100, making it an attractive option for those looking to start small.

- Examples of CDs:

-

- Bank of America’s CDs

-

- Wells Fargo’s CDs

- Benefits of CDs:

-

- Low risk

-

- Fixed returns

-

- Liquidity

8. Money Market Funds

Money market funds are a type of investment that invests in low-risk, short-term debt securities. They offer a low-risk investment option and can be a good choice for those looking for a liquid investment. With money market funds, users can invest as little as $100, making it an attractive option for those looking to start small.

- Examples of money market funds:

-

- Vanguard’s Prime Money Market Fund

-

- Fidelity’s Cash Reserves

- Benefits of money market funds:

-

- Low risk

-

- Liquidity

-

- Low costs

9. Treasury Bills

Treasury bills are short-term government securities with a maturity period of less than a year. They offer a low-risk investment option and can be a good choice for those looking for a fixed return. With treasury bills, users can invest as little as $100, making it an attractive option for those looking to start small.

- Examples of treasury bills:

-

- U.S. Treasury Bills

-

- T-Bills

- Benefits of treasury bills:

-

- Low risk

-

- Fixed returns

-

- Liquidity

10. Cryptocurrency

Cryptocurrency, such as Bitcoin or Ethereum, is a digital currency that uses cryptography for security. Investing in cryptocurrency can be a high-risk, high-reward option and should be approached with caution. With cryptocurrency, users can invest as little as $100, making it an attractive option for those looking to start small.

- Examples of cryptocurrency:

-

- Bitcoin

-

- Ethereum

- Benefits of cryptocurrency:

-

- Potential for high returns

-

- Decentralization

-

- Accessibility

FAQs

Q: What is the minimum amount required to start investing?

A: The minimum amount required to start investing varies depending on the investment option. Some micro-investing apps, such as Acorns, allow users to invest as little as $1, while others, such as index funds or ETFs, may require a minimum investment of $100.

Q: What are the risks associated with investing?

A: Investing always carries some level of risk. The risks associated with investing include market volatility, liquidity risk, and credit risk. However, by diversifying a portfolio and investing for the long term, users can minimize risk and increase potential returns.

Q: How do I get started with investing?

A: Getting started with investing is easy. First, choose an investment option that aligns with your financial goals and risk tolerance. Then, open an account with a broker or investment platform, and deposit funds into your account. Finally, start investing and monitor your portfolio regularly.

Pro Tips

-

- Start small and diversify your portfolio to minimize risk.

-

- Invest for the long term to ride out market volatility.

-

- Automate your investments to make saving and investing easier.

-

- Educate yourself on investing and personal finance to make informed decisions.

Mistakes to Avoid

-

- Investing too much in a single asset or sector.

-

- Not diversifying a portfolio.

-

- Investing without a clear financial goal or strategy.

-

- Not monitoring a portfolio regularly.

Best Practices

-

- Invest regularly to take advantage of dollar-cost averaging.

-

- Reinvest dividends to increase potential returns.

-

- Keep costs low by choosing low-cost investment options.

-

- Stay informed about market trends and economic conditions.

Conclusion

Investing with just $100 is possible and can be a great way to start building wealth. By choosing a low-cost investment option and diversifying a portfolio, users can minimize risk and increase potential returns. Whether it’s through micro-investing apps, index funds, or ETFs, there are many ways to start investing with just $100. So, what are you waiting for? Start investing today and take the first step towards securing your financial future.