Index Funds vs ETFs: Understanding the Key Differences for Smart Investors

As a smart investor, it’s essential to understand the differences between index funds and ETFs to make informed decisions about your investment portfolio. With the rise of passive investing, both index funds and ETFs have become popular choices among investors. However, they have distinct characteristics that set them apart. In this article, we’ll delve into the world of index funds and ETFs, exploring their definitions, advantages, and disadvantages, as well as providing tips and best practices for smart investing.

What are Index Funds?

Index funds are a type of mutual fund that tracks a specific stock market index, such as the S&P 500 or the Dow Jones Industrial Average. They aim to replicate the performance of the underlying index by holding a representative sample of the same securities. Index funds are often considered a low-cost and efficient way to gain broad diversification and potentially earn returns similar to those of the overall market.

What are ETFs?

ETFs, or exchange-traded funds, are similar to index funds in that they also track a specific index or sector. However, unlike index funds, ETFs are traded on an exchange like stocks, allowing investors to buy and sell them throughout the day. ETFs offer flexibility and transparency, as their holdings are disclosed daily, and their prices are updated in real-time.

Key Differences between Index Funds and ETFs

While both index funds and ETFs offer a way to invest in a diversified portfolio, there are key differences between the two. Here are some of the main differences:

-

- Trading flexibility: ETFs can be traded throughout the day, allowing investors to quickly respond to market changes. Index funds, on the other hand, are typically traded at the end of the day, after the market has closed.

-

- Transparency: ETFs disclose their holdings daily, whereas index funds typically disclose their holdings quarterly or monthly.

-

- Tax efficiency: ETFs are generally more tax-efficient than index funds, as they don’t have to sell securities to meet investor redemptions, which can trigger capital gains taxes.

-

- Cost: ETFs often have lower fees than index funds, especially for smaller investors.

-

- Investment minimums: Index funds often have higher investment minimums than ETFs, which can be purchased with a smaller amount of money.

Advantages of Index Funds

Index funds have several advantages that make them a popular choice among investors. Some of the benefits include:

-

- Low costs: Index funds are often less expensive than actively managed funds, with lower fees and expenses.

-

- Diversification: Index funds offer broad diversification, reducing the risk of investing in individual securities.

-

- Consistency: Index funds tend to be less volatile than actively managed funds, as they track a specific index.

-

- Simplicity: Index funds are often easy to understand and require minimal effort to manage.

Advantages of ETFs

ETFs also have several advantages that make them an attractive option for investors. Some of the benefits include:

-

- Flexibility: ETFs can be traded throughout the day, allowing investors to quickly respond to market changes.

-

- Transparency: ETFs disclose their holdings daily, providing investors with up-to-date information about their portfolio.

-

- Tax efficiency: ETFs are generally more tax-efficient than index funds, as they don’t have to sell securities to meet investor redemptions.

-

- Low costs: ETFs often have lower fees than index funds, especially for smaller investors.

Disadvantages of Index Funds and ETFs

While both index funds and ETFs have several advantages, they also have some disadvantages. Here are some of the main drawbacks:

-

- Lack of control: Both index funds and ETFs track a specific index or sector, which means investors have limited control over their portfolio.

-

- No potential for outperformance: Since index funds and ETFs track a specific index, they are unlikely to outperform the market.

-

- Fees and expenses: Both index funds and ETFs have fees and expenses, which can eat into investor returns.

-

- Trading costs: ETFs can incur trading costs, such as commissions and bid-ask spreads, which can add up over time.

Mistakes to Avoid

When investing in index funds or ETFs, there are several mistakes to avoid. Here are some common pitfalls:

-

- Not doing your research: It’s essential to research and understand the index fund or ETF before investing.

-

- Not diversifying: Failing to diversify your portfolio can increase risk and reduce potential returns.

-

- Not monitoring your portfolio: It’s crucial to regularly review and adjust your portfolio to ensure it remains aligned with your investment goals.

-

- Not considering fees and expenses: Fees and expenses can significantly impact investor returns, so it’s essential to consider them when choosing an index fund or ETF.

Best Practices for Smart Investing

To get the most out of your index fund or ETF investments, here are some best practices to follow:

-

- Set clear investment goals: Define your investment goals and risk tolerance to determine the right index fund or ETF for your needs.

-

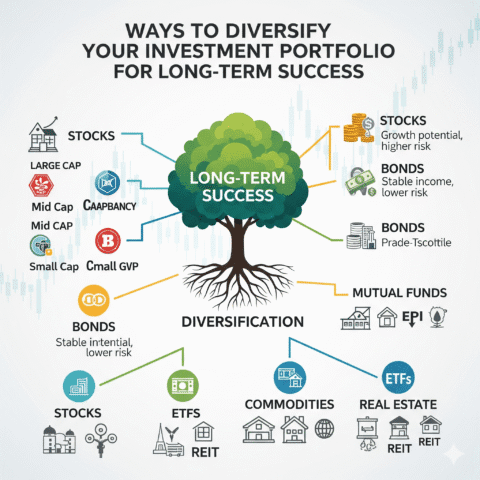

- Diversify your portfolio: Spread your investments across different asset classes and sectors to minimize risk and maximize potential returns.

-

- Monitor and adjust: Regularly review your portfolio and adjust as needed to ensure it remains aligned with your investment goals.

-

- Keep costs low: Minimize fees and expenses by choosing low-cost index funds or ETFs and avoiding unnecessary trading costs.

FAQs

Here are some frequently asked questions about index funds and ETFs:

-

- What is the difference between an index fund and an ETF?: An index fund is a type of mutual fund that tracks a specific index, while an ETF is a type of investment fund that trades on an exchange like a stock.

-

- Which is better, an index fund or an ETF?: The choice between an index fund and an ETF depends on your individual investment goals and needs. Both have their advantages and disadvantages, so it’s essential to research and understand the differences before making a decision.

-

- Can I invest in both index funds and ETFs?: Yes, you can invest in both index funds and ETFs as part of a diversified portfolio.

-

- How do I choose the right index fund or ETF?: Choose an index fund or ETF that aligns with your investment goals and risk tolerance. Consider factors such as fees, expenses, and trading costs, as well as the underlying index or sector.

Conclusion

In conclusion, index funds and ETFs are both popular investment options that offer a way to invest in a diversified portfolio. While they have some similarities, they also have some key differences. By understanding the advantages and disadvantages of each, as well as following best practices for smart investing, you can make informed decisions about your investment portfolio. Remember to set clear investment goals, diversify your portfolio, monitor and adjust, and keep costs low to get the most out of your index fund or ETF investments.