Introduction

The world of cryptocurrency has undergone significant transformations since the advent of Bitcoin in 2009. One of the most critical components of the crypto ecosystem is mining, the process by which new coins are created and transactions are validated. As we step into 2025, a question lingers in the minds of enthusiasts and investors: Is crypto mining still profitable? In this article, we will delve into the current state of crypto mining, exploring its challenges, profitability, and what the future holds.

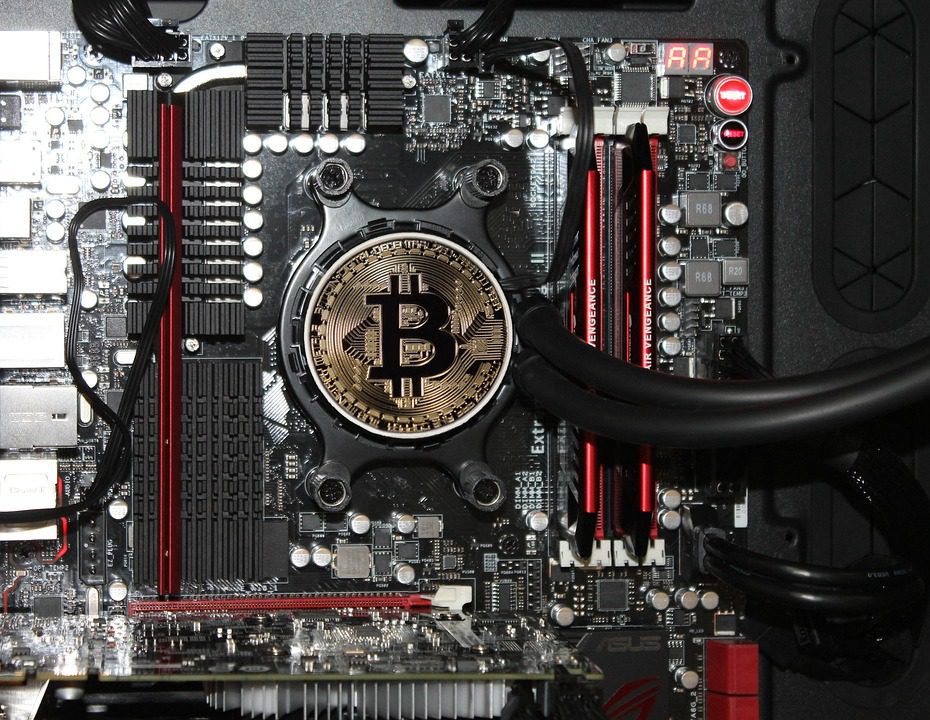

What is Crypto Mining?

Before we dive into the profitability aspect, let’s briefly understand what crypto mining is. Crypto mining is the process of using powerful computers to solve complex mathematical problems, which helps in validating transactions and creating new coins. Miners compete to solve these problems, and the first one to do so gets to add a new block of transactions to the blockchain and is rewarded with a certain number of coins.

The Evolution of Crypto Mining

Over the years, crypto mining has evolved significantly. Initially, it was possible to mine Bitcoins using personal computers, but as the network grew and the difficulty of solving the mathematical problems increased, more powerful hardware was required. Today, Application-Specific Integrated Circuits (ASICs) and Graphics Processing Units (GPUs) are the norm for mining cryptocurrencies. The evolution of mining hardware has been a cat-and-mouse game between miners seeking to increase their chances of solving the puzzles first and the networks adjusting their difficulty levels to maintain a consistent block creation rate.

Challenges Facing Crypto Mining

Despite its potential for profitability, crypto mining faces several challenges:

-

- Energy Consumption: Crypto mining is energy-intensive, contributing to environmental concerns and high electricity bills for miners.

-

- Regulatory Uncertainty: The legal status of cryptocurrencies varies by country, creating uncertainty for miners.

-

- Market Volatility: The value of cryptocurrencies can fluctuate rapidly, affecting mining profitability.

-

- Hardware Costs: The cost of mining equipment can be prohibitively expensive for individual miners.

-

- Competition: The mining space is highly competitive, with large-scale operations often having an advantage over smaller ones.

Profitability of Crypto Mining

The profitability of crypto mining depends on several factors, including:

-

- The type of cryptocurrency being mined: Different cryptocurrencies have different block rewards and transaction fees.

-

- The cost of electricity: Miners in areas with low electricity costs have a significant advantage.

-

- The efficiency of the mining hardware: More efficient hardware can reduce electricity costs and increase profitability.

-

- The current market price of the cryptocurrency: A higher market price can make mining more profitable.

To give you a better understanding, let’s consider an example. Suppose you’re mining Bitcoin using an ASIC miner that consumes 1.5 kW of power. If your electricity cost is $0.12 per kWh, and you’re able to mine 0.1 Bitcoins per month (which is a rough estimate and actual mining outcomes can vary greatly), and the price of Bitcoin is $40,000, your monthly revenue would be $4,000. However, your monthly electricity cost would be approximately $108 for 720 hours of mining (1.5 kW 720 hours $0.12 per kWh). This is a simplified example and doesn’t account for hardware costs, cooling, and other expenses.

Best Practices for Crypto Mining

For those considering venturing into crypto mining, here are some best practices:

-

- Research: Understand the cryptocurrency you’re mining, its potential for growth, and the mining difficulty.

-

- Cost Management: Minimize your costs, especially electricity, by using efficient hardware and considering hosting your miners in places with low electricity costs.

-

- Diversification: Consider mining different cryptocurrencies to spread your risk.

-

- Stay Updated: Keep up with the latest trends, regulatory changes, and advancements in mining technology.

Pro Tips

-

- Join a Mining Pool: Mining pools allow you to combine your resources with other miners, increasing your chances of solving the mathematical problems and getting a reward.

-

- Consider Cloud Mining: If you don’t want to deal with the hassle of physical mining equipment, cloud mining services allow you to rent mining power.

-

- Monitor Your Operations: Regularly check your miners’ performance, temperature, and other vital signs to ensure optimal operation.

Mistakes to Avoid

-

- Underestimating Costs: Don’t overlook the costs of mining, including electricity, hardware, and maintenance.

-

- Ignoring Market Trends: Failing to monitor market fluctuations can lead to mining at a loss.

-

- Lack of Security: Ensure your mining operation and wallet are secure to prevent theft.

Future Prospects

The future of crypto mining is uncertain but promising. As cryptocurrencies continue to gain mainstream acceptance, the demand for mining could increase. Moreover, advancements in technology are making mining more efficient and potentially less harmful to the environment. For instance, the shift towards Proof of Stake (PoS) consensus algorithms in some cryptocurrencies reduces the need for energy-intensive mining.

Frequently Asked Questions

Q: Is crypto mining legal?

A: The legality of crypto mining varies by country. Some countries have embraced cryptocurrencies and mining, while others have banned or restricted them. It’s essential to check the laws in your jurisdiction before starting a mining operation.

Q: How much money can I make from crypto mining?

A: The amount of money you can make from crypto mining depends on several factors, including the cryptocurrency you’re mining, the cost of electricity, the efficiency of your mining hardware, and the current market price of the cryptocurrency.

Q: What is the best cryptocurrency to mine?

A: The best cryptocurrency to mine can vary depending on your circumstances, such as your budget, available hardware, and electricity costs. It’s crucial to research and choose a cryptocurrency that aligns with your resources and goals.

Q: Can I mine cryptocurrency on my laptop?

A: While it’s technically possible to mine cryptocurrency on a laptop, it’s not the most efficient or profitable way to do so. Laptops are not designed for the intense computational work required for mining and can overheat or suffer from reduced performance.

Conclusion

Crypto mining in 2025 presents both opportunities and challenges. While it can be profitable, it’s crucial to approach it with a clear understanding of the costs, risks, and potential rewards. By following best practices, staying informed, and adapting to the evolving landscape of cryptocurrencies, individuals can navigate the complex world of crypto mining successfully. Whether you’re a seasoned miner or just considering entering the space, remember that knowledge and flexibility are key to maximizing your profits in this dynamic and rapidly changing field.

As you embark on your crypto mining journey, remember to stay updated with the latest developments, consider the environmental impact of your operations, and always prioritize security and efficiency. The future of cryptocurrency is exciting and full of possibilities, and for those willing to learn and adapt, it can be a highly rewarding venture.