Roth IRA vs Traditional IRA: Which is Right for Your Retirement Savings?

Choosing the right Individual Retirement Account (IRA) can significantly impact your retirement savings. With multiple options available, it’s essential to understand the differences between a Roth IRA and a Traditional IRA. In this comprehensive guide, we’ll delve into the details of both types of IRAs, exploring their benefits, drawbacks, and eligibility requirements to help you make an informed decision.

Introduction to IRAs

IRAs are tax-advantaged retirement savings accounts that allow individuals to save for their golden years. There are several types of IRAs, but Roth and Traditional IRAs are the most popular. Both types offer unique benefits, and understanding these differences is crucial for maximizing your retirement savings.

What is a Traditional IRA?

A Traditional IRA is a type of IRA that allows contributions to be tax-deductible. The money grows tax-deferred, meaning you won’t pay taxes on the investment gains until you withdraw the funds. Traditional IRAs are ideal for those who expect to be in a lower tax bracket during retirement.

Benefits of Traditional IRAs

-

- Tax-deductible contributions: Reduce your taxable income by contributing to a Traditional IRA.

-

- Tax-deferred growth: Your investments grow tax-free until withdrawal.

-

- Flexibility: You can withdraw funds at any time, but be aware that withdrawals before age 59 1/2 may be subject to a 10% penalty.

Drawbacks of Traditional IRAs

-

- Required Minimum Distributions (RMDs): You must take RMDs starting at age 72, which can increase your taxable income.

-

- Taxes on withdrawals: You’ll pay taxes on withdrawals, which can reduce your retirement income.

What is a Roth IRA?

A Roth IRA is a type of IRA that allows contributions with after-tax dollars. The money grows tax-free, and withdrawals are tax-free if certain conditions are met. Roth IRAs are ideal for those who expect to be in a higher tax bracket during retirement.

Benefits of Roth IRAs

-

- Tax-free growth and withdrawals: Your investments grow tax-free, and withdrawals are tax-free if you’ve had the account for at least five years and are 59 1/2 or older.

-

- No RMDs: You’re not required to take RMDs during your lifetime, allowing you to keep the money in the account for as long as you want.

-

- Flexibility: You can withdraw contributions (not earnings) at any time tax-free and penalty-free.

Drawbacks of Roth IRAs

-

- Non-deductible contributions: You’ve already paid taxes on the money you contribute, so you can’t deduct it from your taxable income.

-

- Income limits: Roth IRA contributions are subject to income limits, which may reduce or eliminate your ability to contribute.

Comparison of Roth and Traditional IRAs

When deciding between a Roth IRA and a Traditional IRA, consider the following factors:

Contribution Limits

The annual contribution limit for both Roth and Traditional IRAs is $6,000 in 2022, or $7,000 if you’re 50 or older. However, Roth IRA contributions are subject to income limits, which may reduce or eliminate your ability to contribute.

Tax Benefits

Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free growth and withdrawals. Consider your current tax bracket and expected tax bracket in retirement when deciding which type of IRA is best for you.

Investment Options

Both Roth and Traditional IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. However, some investments, such as life insurance and collectibles, are not allowed in IRAs.

Eligibility Requirements

To contribute to a Traditional IRA, you must have earned income from a job. To contribute to a Roth IRA, you must have earned income from a job and your income must be below certain thresholds.

FAQs

Can I have both a Roth IRA and a Traditional IRA?

Yes, you can have both a Roth IRA and a Traditional IRA. However, your total contributions to both accounts cannot exceed the annual limit.

Can I convert a Traditional IRA to a Roth IRA?

Yes, you can convert a Traditional IRA to a Roth IRA. However, you’ll need to pay taxes on the converted amount, and there may be income limits and other restrictions.

Can I withdraw money from an IRA at any time?

Yes, you can withdraw money from an IRA at any time, but you may be subject to penalties and taxes. With a Traditional IRA, withdrawals before age 59 1/2 may be subject to a 10% penalty, and you’ll pay taxes on the withdrawn amount. With a Roth IRA, you can withdraw contributions tax-free and penalty-free at any time, but withdrawals of earnings before age 59 1/2 or within five years of opening the account may be subject to taxes and a 10% penalty.

Pro Tips and Mistakes to Avoid

Start early

The sooner you start saving for retirement, the more time your money has to grow.

Contribute consistently

Make consistent contributions to your IRA to maximize your retirement savings.

Avoid withdrawing from your IRA too early

Withdrawing from your IRA too early can result in penalties and taxes, reducing your retirement income.

Consider your tax bracket

Consider your current tax bracket and expected tax bracket in retirement when deciding between a Roth IRA and a Traditional IRA.

Best Practices

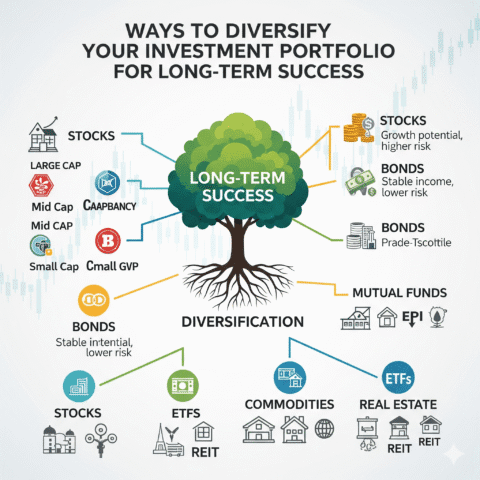

Diversify your investments

Diversify your investments to minimize risk and maximize returns.

Monitor and adjust your portfolio

Monitor your portfolio regularly and adjust it as needed to ensure it remains aligned with your retirement goals.

Consider professional advice

Consider seeking professional advice from a financial advisor to determine the best retirement savings strategy for your individual circumstances.

Conclusion

In conclusion, both Roth IRAs and Traditional IRAs offer unique benefits and drawbacks. When deciding which type of IRA is right for you, consider your current tax bracket, expected tax bracket in retirement, and individual circumstances. By starting early, contributing consistently, and avoiding common mistakes, you can maximize your retirement savings and achieve your long-term financial goals. Remember to consult with a financial advisor if you’re unsure about which type of IRA is best for you.

Take the first step towards securing your retirement today by opening a Roth IRA or Traditional IRA. With careful planning and consistent savings, you can create a comfortable and secure retirement for yourself.