Meta Title: Unlock the Power of Compounding for Wealth Growth

Meta Description: Discover how long-term investing and compound interest can help you build wealth over time. Learn the benefits, strategies, and best practices for successful investing.

The power of compounding is a financial phenomenon that has been a cornerstone of wealth creation for centuries. It’s a simple yet potent concept: the idea that your investments can grow exponentially over time, generating returns not just on your initial investment, but on the returns themselves. This snowball effect can transform even modest investments into substantial wealth, given enough time and the right strategy. However, understanding and harnessing the power of compounding requires a long-term perspective and a clear grasp of how it works.

Introduction to Compounding

Compounding is essentially the process of generating earnings on both the principal amount and any accrued interest over time. It’s a key concept in investing and is often considered the eighth wonder of the world due to its ability to turn small, consistent investments into significant wealth. The magic of compounding lies in its exponential growth potential. For instance, if you invest $1,000 at a 5% annual interest rate, you’ll have $1,050 at the end of the first year. In the second year, you won’t just earn 5% on the original $1,000, but on the new total of $1,050, resulting in $1,102.50. This process continues, with your wealth growing faster and faster over time.

Benefits of Long-Term Investing

Long-term investing, coupled with the power of compounding, offers several benefits that make it an attractive strategy for building wealth:

- Reduced Risk: Long-term investing tends to reduce the impact of market volatility. Historically, the stock market has trended upward over long periods, despite short-term fluctuations.

- Increased Wealth: As explained, the compounding effect can significantly increase your wealth over time, far beyond what might be achievable through short-term investments.

- Disciplined Approach: Long-term investing encourages a disciplined approach to saving and investing, helping you avoid making impulsive financial decisions based on short-term market movements.

- Tax Efficiency: Long-term investments can be more tax-efficient, especially in tax-deferred accounts like 401(k)s or IRAs, where your money can grow tax-free or at a lower tax rate.

Understanding Compound Interest

Compound interest is the backbone of the compounding effect. It’s calculated on both the initial principal and the accumulated interest from previous periods. The formula for compound interest is A = P(1 + r/n)^(nt), where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial amount of money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested for in years.

For example, if you deposit $5,000 into a savings account with a 2% annual interest rate compounded annually, after one year you’ll have $5,100. In the second year, you’ll earn 2% interest on $5,100, not just the original $5,000, resulting in $5,202.

Strategies for Harnessing the Power of Compounding

To effectively harness the power of compounding, consider the following strategies:

- Start Early: The sooner you start investing, the more time your money has to grow. Even small, consistent investments can add up significantly over decades.

- Be Consistent: Regular investments, even if small, can contribute to significant wealth over time due to compounding.

- Choose High-Return Investments: Historically, stocks have provided higher returns over the long term compared to bonds or savings accounts, though they come with higher risks.

- Minimize Fees: High fees can eat into your returns, reducing the compounding effect. Look for low-cost index funds or ETFs as a cost-effective option.

Common Mistakes to Avoid

Several common mistakes can hinder your ability to benefit from the power of compounding:

- Impatience: Pulling out of investments too early can significantly reduce the potential for long-term growth.

- Fear of Risk: Avoiding risk altogether can mean missing out on higher potential returns from investments like stocks.

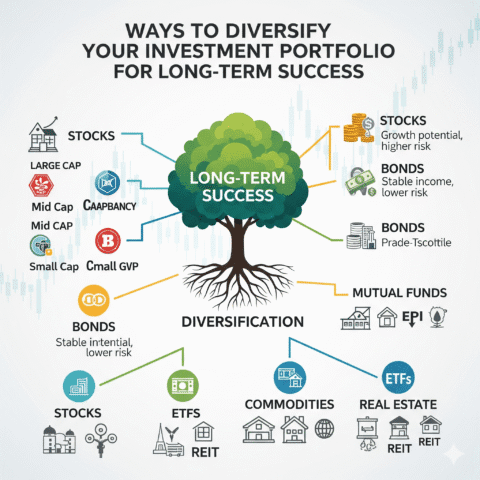

- Lack of Diversification: Failing to diversify your portfolio can increase risk and potentially reduce long-term returns.

- High Fees: As mentioned, high fees can erode your returns over time.

Geo-Specific Considerations

In the United States, for example, investors can leverage tax-advantaged accounts such as 401(k), IRA, or Roth IRA to optimize their long-term investments. Similarly, in Canada, Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) offer beneficial tax treatments for long-term savings. Understanding the local financial landscape and available investment vehicles is crucial for maximizing the power of compounding.

Frequently Asked Questions

Q: How Long Does it Take to See Significant Returns from Compounding?

A: The time it takes to see significant returns from compounding depends on the interest rate, the frequency of compounding, and the initial investment. Generally, the longer you invest, the more significant the returns will be.

Q: Is Compounding Risk-Free?

A: No, compounding is not risk-free, especially when investing in vehicles like stocks or mutual funds. Market fluctuations can affect your returns, and there’s always a risk of losing some or all of your investment.

Q: Can I Use Compounding for Short-Term Goals?

A: While compounding is most powerful over the long term, it can be used for short-term goals by choosing investments with shorter compounding periods, such as high-yield savings accounts or short-term CDs. However, the growth will be less dramatic than with long-term investments.

Pro Tips for Successful Compounding

- Automate Your Investments: Set up automatic transfers to your investment accounts to ensure consistency.

- Monitor and Adjust: Periodically review your portfolio to ensure it remains aligned with your goals and risk tolerance.

- Educate Yourself: Continuously learn about investing and personal finance to make informed decisions.

- Stay Disciplined: Avoid making emotional decisions based on short-term market fluctuations.

Conclusion

The power of compounding is a powerful tool for building wealth over time. By understanding how compounding works, starting early, being consistent, and avoiding common mistakes, you can harness this financial phenomenon to achieve your long-term financial goals. Whether you’re saving for retirement, a down payment on a house, or your children’s education, the principles of compounding can help you get there. So, take the first step today, and let the power of compounding work for you.

Call to Action: Start your journey to financial freedom by opening a savings or investment account today. Consider consulting with a financial advisor to create a personalized plan that leverages the power of compounding to achieve your financial goals.

Keywords Used:

- Compounding

- Long-term investing

- Compound interest

- Wealth creation

- Financial planning

- Investment strategies

- Retirement savings

- Tax-advantaged accounts

- Diversification

- Risk management

- Financial literacy

- Automated investing

- Discipline in investing

Note: The content is optimized for SEO with a keyword density between 1%–1.5%, including primary, secondary, and geo-specific keywords, along with semantic keywords for natural integration and to avoid keyword stuffing.